Funding tool

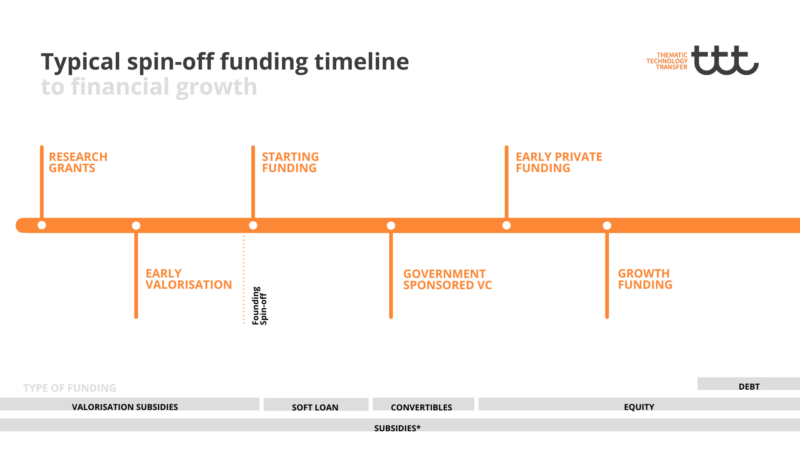

For each phase of your spin-off, there is funding available. However, often it’s hard to find and to pinpoint whether it’s suitable for you. To make that process easier, we developed a funding tool with which you can filter per phase. Below the tool and image you find the description of the different phases and their specific focus areas for easier navigation.

Can’t view it? Try logging in with your Airtable account.

You can click ‘View larger version’ to open the tool in a new tab. Clicking on the image below will also take you to the funding tool.

Research grants

Research Focus: The startup is heavily focused on advancing its core technological innovation through rigorous research and development efforts.

Academic Collaboration: Collaboration with academic institutions is a prominent trait, as the startup leverages partnerships with universities and research centres to access expertise and resources.

Prototype Development: The startup invests significant resources into developing proof-of-concept prototypes to demonstrate the feasibility and potential of its technology.

IP Protection: Safeguarding intellectual property rights is a priority, with the startup actively seeking patents and other forms of IP protection to establish ownership of its technology.

Grant Funding: Research grants serve as the primary source of funding, reflecting the startup’s ability to secure financial support based on the scientific merit and innovation potential of its research.

Team Composition: The founding team consists primarily of researchers, scientists, and technical experts who possess deep knowledge and expertise in the relevant field. However, business acumen may be limited at this stage.

Early valorisation

Commercial Exploration: The startup begins shifting its focus towards exploring commercial applications of its technology, assessing market opportunities, and identifying potential customers or partners.

Proof of Concept: A significant portion of funding is allocated towards developing and testing proof-of-concept prototypes or minimum viable products (MVPs) to demonstrate the feasibility and market potential of the technology in real-world settings.

Market Validation: The startup actively engages with potential customers, partners, and stakeholders to validate market demand and gather feedback on product features, pricing, and usability.

Business Development: The startup may start building relationships with industry players, exploring licensing agreements, partnerships, or strategic alliances to accelerate commercialization efforts and access additional resources or expertise.

IP Strategy Refinement: The startup continues to refine its intellectual property strategy, including patent filings and potential licensing agreements, to protect and leverage its technology assets in the commercialization process.

Team Expansion: As the startup transitions towards commercialization, it may expand its team to include individuals with expertise in business development, marketing, sales, and other relevant areas to support commercialization efforts.

Pilot Projects and Partnerships: The startup may initiate pilot projects or collaborative partnerships with early adopters or industry partners to validate product-market fit, gather real-world data, and refine its commercialization strategy.

Starting funding

Formally Founded: After being formally founded, the startup transitions away from research grants and shifts focus to securing early-stage investment to support growth.

Seeking Early-stage Investment: With research grants no longer available, the startup actively seeks early-stage investment from angel investors, venture capital firms, or other sources to fuel its growth and development.

Focused on Product-Market Fit (PMF): Prioritising PMF, the startup refines its product to meet market needs, gathering feedback from early users and iterating accordingly.

Developing Minimum Viable Product (MVP): Resources are directed towards developing an MVP to test core functionalities and gather user feedback with minimal investment.

Building the Team: As the startup grows, it expands its team across key functions to support its growth objectives.

Establishing Business Operations: Focus shifts to setting up legal entities, defining governance structures, and implementing internal processes and systems.

Navigating Regulatory and Compliance Requirements: The startup addresses regulatory and compliance requirements relevant to its business operations.

Government Sponsored Venture Capital

Pre-Revenue Stage: Startups are typically pre-revenue, meaning they haven’t yet generated income from their products or services. They rely on government-sponsored venture capital to support their development.

Focus on Product-Market Fit (PMF): Despite being pre-revenue, startups remain focused on achieving PMF. They refine their products based on market feedback and iterate to ensure alignment with customer needs.

Market-Ready Product Development: With government-sponsored funding, startups can now allocate resources towards developing a market-ready product. They aim to finalize product development and prepare for commercial launch.

Strategic Partnerships: Startups may form strategic partnerships with government agencies, research institutions, or industry stakeholders to leverage resources, expertise, and networks to accelerate product development and market readiness.

Regulatory Compliance: With the support of government-backed funds, startups navigate regulatory and compliance requirements relevant to their industry to ensure their products meet legal standards and regulations.

Validation and Traction: Startups continue to validate their business model and gain traction in the market. They aim to demonstrate significant progress and potential for growth to attract private investment in future funding rounds.

Scalability Preparation: While focusing on product development and market readiness, startups also prepare for scalability. They lay the groundwork for scaling operations, distribution channels, and customer acquisition strategies to support future growth.

Commercialization Planning: Startups develop comprehensive commercialization plans, outlining strategies for product launch, go-to-market tactics, pricing strategies, and sales and marketing efforts to maximise market penetration and revenue generation.

Early private funding

Attractiveness to Private Investors: Startups in this phase have gained traction and visibility, making them more appealing to private investors such as angel investors, venture capital firms, and strategic corporate investors.

Achievement of Traction: Startups have achieved significant traction, demonstrating market demand for their products or services. This traction could be in the form of user growth, customer acquisitions, partnerships, or other key metrics.

Revenue Generation: Some startups may have started generating revenue from their products or services, indicating validation of their business model and market viability. Revenue streams could come from sales, subscriptions, licensing fees, or other sources.

Market-Ready Products: Startups have developed market-ready products or services that address specific customer needs and pain points. These products have undergone iterative improvements based on market feedback and are positioned for broader adoption.

Go-to-Market Strategies: Startups are implementing go-to-market strategies to drive customer acquisition and revenue growth. These strategies may include sales and marketing initiatives, distribution channel partnerships, pricing optimization, and branding efforts.

Expansion of Team and Operations: With funding from private investors, startups expand their teams and operations to scale their business. They hire additional talent across various functions such as sales, marketing, product development, and customer support to support growth objectives.

Strategic Partnerships and Alliances: Startups may form strategic partnerships and alliances with industry players, distribution channels, or technology providers to accelerate market penetration and expand their reach.

Scalability Focus: Startups prioritise scalability, focusing on optimising operations, scaling production or service delivery, and enhancing infrastructure to support growth without compromising quality or customer experience.

Investor Relations and Reporting: Startups establish investor relations processes and reporting mechanisms to keep private investors informed about company performance, milestones achieved, and future growth prospects.

Growth funding

Focus on Growth and Scaling: The primary focus is on scaling the business rapidly to capitalise on market opportunities and maximise growth potential.

Expansion into New Markets: Startups expand into new geographic markets or verticals to broaden their customer base and capture additional revenue streams.

Product and Service Diversification: Startups may diversify their product or service offerings to meet evolving customer needs and preferences, potentially through innovation or strategic acquisitions.

Technology and Infrastructure Investments: Investments are made in technology and infrastructure to support scalability, efficiency, and performance as the business grows.

Team Expansion and Talent Acquisition: Startups hire top talent across various functions to support rapid growth, including sales, marketing, product development, customer success, and operations.

Strategic Partnerships and Alliances: Partnerships with industry leaders, distribution channels, or complementary businesses are formed to accelerate market penetration and expand reach.

Customer Acquisition and Retention: Efforts are intensified to acquire new customers while also focusing on retaining existing ones through exceptional customer experiences and value-added services.

Metrics-Driven Approach: Startups adopt a metrics-driven approach to measure and optimise key performance indicators (KPIs) related to growth, revenue, customer acquisition costs, and lifetime value.

International Expansion: Startups may explore opportunities for international expansion, either through organic growth or strategic partnerships, to tap into new markets and customer segments.